Financial Word of the Day: Moving Average

- Larry Jones

- Oct 10, 2025

- 2 min read

Definition of Moving Average

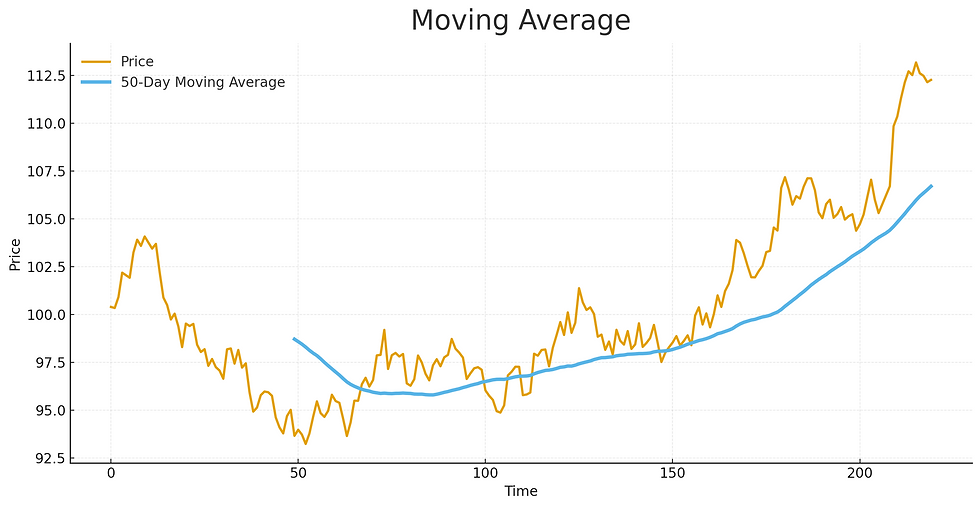

A moving average (MA) is a calculation that helps smooth out price data by creating a constantly updated average price over a specific time period. Investors and traders use moving averages to identify trends and potential buy or sell signals by filtering out short-term price noise.

For example, a 50-day moving average adds up the closing prices of the last 50 days and divides by 50. Each new day, the oldest data point drops off and the newest one gets added—hence, the average “moves.”

Why a Moving Average Matters

Moving averages are one of the most common tools used in both technical analysis and general investing because they help answer a simple question: Is this stock (or market) trending up or down?

When the price is above the moving average → that’s generally a bullish (upward) signal.

When the price is below the moving average → that’s typically bearish (downward).

When two moving averages cross—say, a short-term 50-day crosses above a long-term 200-day—that’s called a Golden Cross (a strong buy signal).When it crosses below, it’s a Death Cross (a potential sell signal).

Think of a moving average like a boat cutting through choppy water: the waves represent daily volatility, and the smooth wake behind the boat shows the long-term direction. That’s what an MA helps you see—the smoother, steadier path beneath the surface chaos.

How You Might Use It

Let’s say you’re following Apple stock. The price jumps around every day—$187 one day, $192 the next, then back to $185. A 50-day moving average might show you that, despite the short-term noise, Apple’s price trend has been steadily rising.

You could use that insight to make smarter investment decisions:

Stay invested through temporary dips if the overall trend is positive.

Wait to buy until the stock’s price climbs back above a key moving average.

Combine it with other signals (like trading volume or momentum) to confirm a trend.

Real-Life Money Takeaway

Even if you’re not a stock trader, the idea of a “moving average” can apply to your personal finances too.

Want to understand your spending trends? Calculate your 3-month moving average of expenses.

Want to see if your savings rate is improving? Track a 6-month moving average of how much you save each month.

The point is—data is noisy. A moving average helps you step back, see the bigger picture, and make more level-headed decisions.

In Conversation

You might hear someone say:

“The S&P 500 just broke above its 200-day moving average—investors are turning bullish again.”

Translation: The long-term trend looks like it’s moving upward.

Bottom Line

The moving average reminds us not to overreact to short-term fluctuations. Whether it’s the stock market or your own financial habits—smooth the noise, follow the trend, and keep moving forward.

Comments