Financial Word of the Day: RSI (Relative Strength Index)

- Larry Jones

- Oct 14, 2025

- 2 min read

Introduction

Ever wish you had a quick way to tell whether an investment is overhyped or undervalued—without needing a crystal ball? That’s where RSI, or Relative Strength Index, steps in.

Definition of RSI (Relative Strength Index)

RSI is a momentum indicator used in technical analysis that measures the speed and change of price movements. It ranges from 0 to 100 and helps investors identify whether an asset—like a stock, ETF, or cryptocurrency—is potentially overbought or oversold.

A reading above 70 typically signals that an asset might be overbought—meaning its price may have risen too far, too fast.

A reading below 30 indicates the asset might be oversold—possibly due for a rebound.

In simpler terms, RSI tells you whether investors have been piling in or bailing out too aggressively.

How RSI Works

The RSI (Relative Strength Index) formula looks at the average gains and average losses over a specific time period—most commonly 14 days. It then compares those numbers to determine momentum. The result is a single number between 0 and 100 that summarizes recent price strength.

While the math behind it can look intimidating, the takeaway is simple: RSI measures the emotional temperature of the market.

High RSI (70–100): The crowd is excited. Prices may be peaking.

Low RSI (0–30): The crowd is fearful. Prices might be near a bottom.

Example of RSI in Action

Imagine you’re watching Apple (AAPL) stock. Its RSI has climbed to 82. That suggests the price has run up quickly and could be due for a short-term pullback. On the other hand, if Apple’s RSI dips to 25, it may signal a buying opportunity because the stock has been oversold.

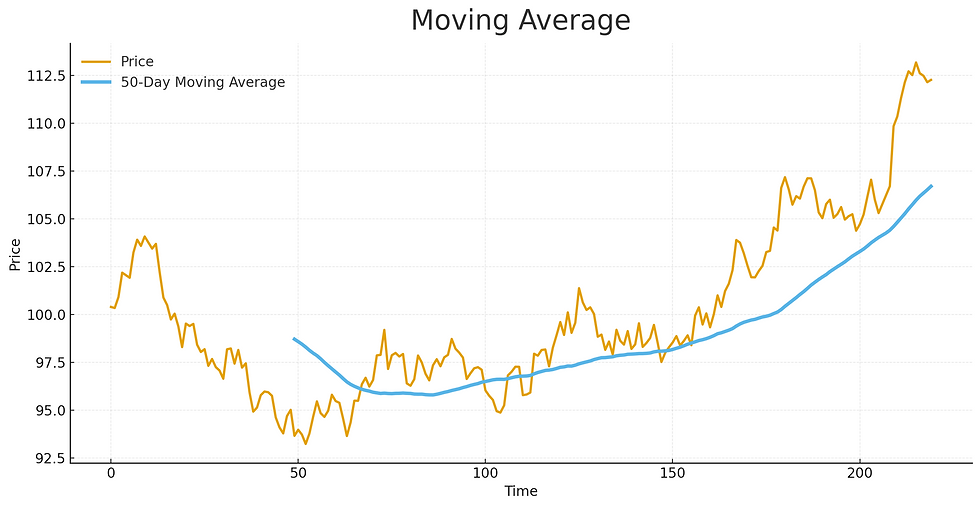

Of course, RSI isn’t a perfect fortune-teller. Markets can stay “overbought” or “oversold” longer than anyone expects. Smart investors use RSI alongside other tools—like moving averages, volume, and trend lines—to confirm what the data is saying.

Conversation Example

“I’m holding off on buying Tesla right now—the RSI is sitting around 78, which usually means it’s overbought. I’ll wait for a better entry point.”

That’s financial fluency in action.

Why RSI Matters

RSI helps you time your moves more intelligently. It’s not about predicting the future—it’s about improving your odds. By understanding market momentum, you can avoid buying when excitement is peaking or panic-selling when fear takes over.

Knowing how to read RSI puts you a step ahead of emotional investors who trade on gut feelings instead of data. And in the long game of building wealth, emotional control usually beats raw enthusiasm.

Bottom Line

The RSI doesn’t replace sound investing principles, but it adds another layer of insight. It reminds you that markets are driven by human behavior—greed and fear—and those patterns show up in the numbers long before they show up in the headlines.

Comments